2023 Annual Report Community Focused Capital

What does it mean for capital to be community focused?

At Locus, we spent months answering that question through the development of our new strategic plan, which we completed last spring. Since then, we have experienced an evolution driven by the mission to be the best community partner we can be. A partner that strives to understand the unique challenges of every community to find solutions that meet their needs. One that can offer a diverse mix of innovative products and services adapted to specific community situations.

We believe community focused capital is the result of centering the visions communities have for themselves in all we do. It’s what happens when we ask a community what success looks like to them, and we let that guide our work. This is the type of partner we intend to be.

Impact Snapshot

Locus Impact by the Numbers

We’re proud of the impact we’ve achieved alongside our many partners since our founding in 2006.

Total Impact

$0 Billion

Our Continued Financial Sustainability

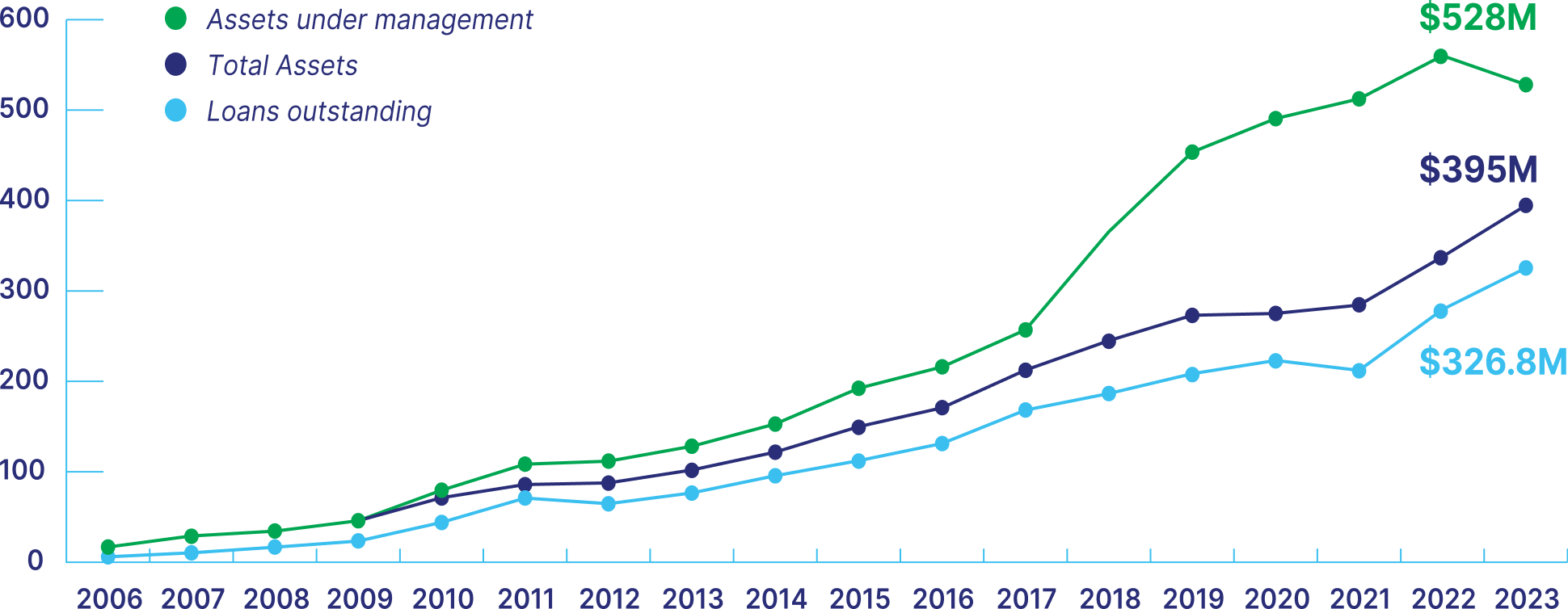

Our financial strength has enabled us to drive greater impact since the beginning

-

$39.1M

net income over 17 years

-

526%*

growth in net assets since inception

*Including non-controlling interest in subsidiary – see audited financial statements for details.

Where We’re Headed

Our 2024 Focus Areas

This year, we see clear opportunities to support our community-embedded partners across Virginia and beyond.

It all starts with our commitment to place, and whether it’s food systems, guarantees, or climate solutions, we’re tapping our expertise and our broad set of tools to make an impact.

Expanding Place-Based Investment

While place has always been a part of Locus’ DNA, we're making a more deliberate connection between place and Locus’ growth.

As a CDFI, “place” shows up in all that we do. Every loan we make drives capital into businesses, organizations, and real estate developments happening in a community. Likewise, institutions that fund and invest in Locus’ work do so because they believe we can make an impact in the cities, counties, towns, or regions that they care about – their “places.” While place has always been a part of Locus’ DNA, our 2022-2025 strategic plan calls for a more deliberate connection between place and Locus’ growth. The Place-Based Investment Strategy (PBIS) is our pathway to doing so. It is important to define what Locus means when we say “PBIS.” Over the past year, we have come to understand that PBIS is both a way of working and a body of work.

When we think about how place shows up in our way of working, simply put, it means leading with a set of values. We want to work in places where our partnership is welcomed and where we have the opportunity and invitation to build relationships across sectors – public, private, and philanthropic. True to our CDFI roots, we want to show up where the capital system is not working for all. When we get there, we engage as learners, working to understand what the shared priorities are in communities and then considering how our tools can help to advance those priorities. And we don’t do this work alone. We work through embedded community organizations; we challenge anchor institutions to unlock their assets to drive benefits in place. Essentially, we support community partners who are committed to equity and inclusion and ensure that our policies and processes reflect that same commitment.

When Locus talks about PBIS, the body of work, what we are referring to is a portfolio of communities to which we are specifically and deeply committed. In 2023, Locus took our first step towards identifying, understanding, and committing to our first “PBIS Community” – these are the places where Locus will undertake a deliberative, months-long exploratory process meant to help our staff connect with local leaders to understand community capital opportunities and challenges. In prospective PBIS Communities, Locus will listen for opportunities where our capital – whether that be human, financial, social, or reputational – can support local partners and leaders to advance shared community investment plans. With PBIS, communities can come to expect a more patient, innovative, and community-rooted Locus. Our success will be defined by community success.

Every journey has a starting point. For us, that starting point was Southside Virginia – a region that historically has not seen significant Locus lending but where our networks and relationships run deep. By working with close partners in Southside, we identified community investment opportunity areas as well as some short-term investment strategies that will allow us to finetune our new approach to community partnerships and build the internal muscle we need to work as an impact-first, integrated community development organization.

In 2024, we are excited to begin advancing our community investment plan in Southside Virginia and exploratory work in 3-4 new “places” in Virginia and another Southeastern state. We look forward to sharing our lessons learned and stories of impact in the months ahead.

Advancing Climate Solutions

It has become imperative that climate change mitigation, adaptation, and resilience become embedded into the traditional focus of community development finance.

“By 2028, 100% of CDFIs should become climate lenders.” This was the call-to-action directed at CDFIs from Harold Pettigrew, CEO of Opportunity Finance Network (OFN), at the 2023 OFN Conference. Climate change poses an unprecedented threat to communities worldwide, especially economically distressed communities that CDFIs exist to serve. These frontline communities often lack the resources and infrastructure to adapt or recover from extreme weather events. They may also lack housing security or healthcare, heightening their likelihood of experiencing adverse health effects due to climate change. Locus has a unique role to play in the just transition to a net-zero green economy that ensures these communities are not left behind. Business as usual is no longer enough, and it has become imperative that climate change mitigation, adaptation, and resilience become embedded into the traditional focus of community development finance.

Locus began its climate finance program back in 2016, issuing its first pair of solar loans to an existing real estate developer borrower. This became our launching point for a clean energy lending program that has seen over $50 million in loan originations since then, resulting in 30 MWs of solar energy developed, enough to power 10,000 homes for a year!

Locus also understands the power of leverage to achieve ambitious climate goals. The Community Investment Guarantee Pool, or CIGP, utilizes unfunded guarantees to unlock and mobilize private capital at scale. Climate finance is a broad, emerging field for community lenders, with new opportunities and risks. By mitigating risk concerns, guarantees can enable new climate lending initiatives to secure the capital needed to launch or expand.

- Locus doubled down on climate finance in 2023.

- Originated our first community solar loan in partnership with the New York City Housing Authority

- Committed to the Partnership for Carbon Accounting Financials, or PCAF, joining 400 other institutions including leading peer CDFIs to measure and disclose carbon emissions associated with our financing

- Locus presented to CDFIs and community lenders at the 2023 OFN Conference on how to start and scale a climate finance program

- Submitted ten letters of support to coalitions submitting application to all three competitions of the $27 billion Greenhouse Gas Reduction Fund, a national-scale program to mobilize private finance and community lenders to address the climate crisis.

As we look to 2024 and beyond, Locus is well positioned to leverage our partnerships, expertise, and capital to achieve an equitable reduction of greenhouse gas emissions and a just transition for all communities and places.

Growing Sustainable Food Systems

We collaborate across regional food systems to improve capital access for food businesses and attract investment into local food economies.

Led by Director of Place-Based & Food Systems Investment Lauren DeSimone, Locus has been working to build the economic resiliency of local food systems in Virginia and beyond for more than a decade. In that time, we have collaborated across the regional food systems to improve capital access for food businesses, provide project- and place-based technical assistance, and attract investment into local food economies. We’ve done this by facilitating a diverse network of partners to build systems capacity and through tools like Locus’ Virginia Fresh Food Loan Fund, a $10 million loan fund offering technical and financial resources that strengthen small businesses along the entire food value chain. Locus also is contracted with the Virginia Department of Agriculture and Consumers Services to provide technical assistance for the Virginia Food Access Investment Fund; co-chairs the Virginia Food Access Coalition; is a Steering Committee member of the National Food Lenders’ Network; and continues supporting regional food systems initiatives and businesses with technical assistance, grants, and debt capital. Now, we’re entering an exciting phase of growth for our food access work.

This year, Locus joined a cohort of partners across five states that has received $30 million in critical funding from the U.S. Department of Agriculture (USDA) to create the Southeast USDA Regional Food Business Center. Part of a national network of 12 Centers, the Southeast regional hub will support a more resilient, diverse, and competitive food system in Virginia, Georgia, North and South Carolina, and Florida. The Center will coordinate outreach among underinvested communities, food businesses, and regional stakeholders; provide technical assistance through grassroots partners; and offer financial assistance through a $4.9 million Business Builder Awards grant program managed by Locus. Serving as program lead is the Georgia Minority Outreach Network (GA MON), an organization with more than 30 years of food systems development and research experience. In addition to the nine organizations that will lead the Center’s work, 19 grassroots collaborators are engaged across the region.

The Southeast USDA RFBC is the only CDFI-led Center in the country. Along with overall fiscal management and reporting, Locus is responsible for coordinating technical assistance in Virginia, convening a regional CDFI network, and, perhaps most importantly, developing a sustainability plan for the Center to ensure longevity beyond the USDA funding. Over the next few years, Locus seeks to build and expand relationships with philanthropic and mission-driven investors across the Southeast region to generate essential investment in regional food systems. We believe the Center is an example of how place-based investing should work – through partnerships with mission-aligned funders and community-embedded organizations. With the right support, it will be a model for how a more resilient, functional regional food system can drive equitable community and economic development.

Evolving Guarantees as a Tool for Equity

Locus guarantees provide credit enhancement for lenders, developers, and other partners in the community development focus areas of climate, housing, and small business.

In December 2019, Locus and a group of philanthropic partners launched the Community Investment Guarantee Pool (CIGP). A first-of-its-kind fund with a nationwide reach and a 15-year program life, CIGP has pooled over $66 million in unfunded commitments from leading foundations and mission-driven institutions. Those commitments allow CIGP to aggregate and deploy financial guarantees that backstop high-impact, equity-driven community development initiatives financed by intermediaries like CDFIs. Since its launch, CIGP has deployed $26.7 million in guarantees that are expected to unlock an estimated $237 million in community development capital.

Locus also took lessons from CIGP and applied them to a place-based context by partnering with the Kauffman Foundation to create a guarantee pool in Kansas City aimed at expanding capital access for historically disinvested entrepreneurs, including business owners of color.

In addition to being an innovative tool for community finance, CIGP has been a learning experiment. From the get-go, the CIGP and its partners have worked with evaluators to establish proof of concept – that guarantees can be a critical tool for equitable deployment of capital. Not only have we found that the guarantees can be efficient and catalytic in unlocking capital for community investing, but they can help to challenge systemic barriers in community development finance that work against women and communities of color by spotlighting actual vs. perceived risk.

Now, as CIGP pursues full deployment by end of year, Locus is exploring the evolution of the guarantee with the goal of developing a permanent vehicle for the community development sector that provides credit enhancement for lenders, developers, and other partners with focus areas of climate, housing, and small business. To get started, Locus will seed this endeavor with a generous $12 million gift from MacKenzie Scott, and investments received via the Greenhouse Gas Reduction Fund will help us support climate-related solutions. But to ensure this tool is around for the long haul, we need the same levels of engagement and partnership that made CIGP such a success. We look forward to working with philanthropic and other private-sector partners to fuel this next iteration of the community development guarantee.

Partnership is Key

Our Impact is Your Impact

Together with you, our partners, we’ve achieved over $3.34 billion in total impact. Now, we’re working to double that number over the next five years.