2024 Impact Report Courageous Financing

We’re proud to share our 2024 Impact Report, Courageous Financing. Our new report shows how we have worked to deliver to communities across the country what matters most: capital, opportunity, and real partnership. Working alongside incredible collaborators, we have been able to strengthen housing, expand access to clean energy, support local food systems, and grow small business ecosystems.

Courageous Financing is more than a theme – it’s a mindset. It means supporting solutions that don’t always fit the mold. It means listening deeply, balancing risk with purpose, and investing in communities that others often overlook.

The stories in this report highlight not only what we’ve done, but how we’ve done it: through deep partnership, bold experimentation, and a belief that progress requires persistence. We know the communities we serve can’t wait for perfect conditions. That’s why we move with urgency and humility – knowing that each investment we make carries the weight of real people, real dreams, and real impact.

Read the full message from Clyde Cornett, our Interim CEO and CFO, on our blog.

Impact Snapshot

Locus Impact by the Numbers

We’re proud of the impact we’ve achieved alongside our many partners since our founding in 2006.

Total Impact

$3.94 Billion

Financial Snapshot

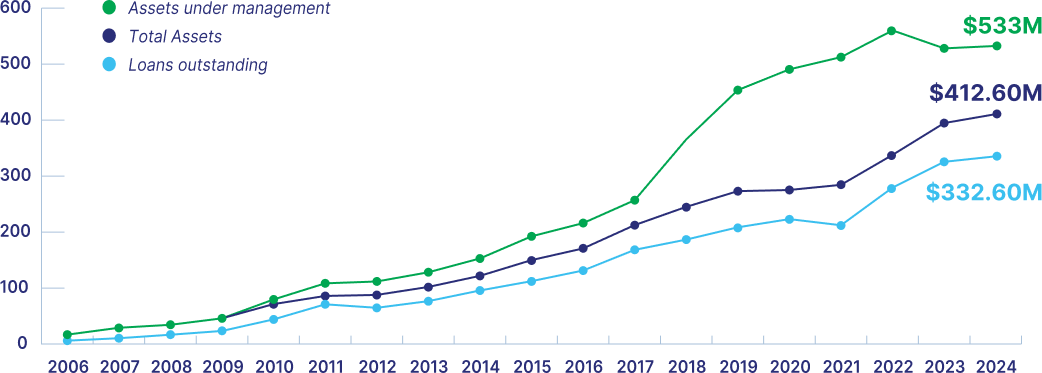

Our Continued Financial Sustainability

Our financial strength has enabled us to drive greater impact since the beginning.

-

$42.4M

net income over 18 years

-

686%*

growth in net assets since inception

*Including non-controlling interest in subsidiary – see audited financial statements for details.

Courage in Action

How We’re Moving Forward

Locus is applying a refreshed approach to impact

management and measurement.

In 2025, we’re launching a new impact scorecard to help assess the depth and breadth of our financing’s impact, ensuring our capital supports projects that create meaningful community benefits. Built around the five dimensions of impact, this tool will help us prioritize investments that align with our mission and drive positive change.

Our Approach to Measuring Impact

As a mission-driven CDFI, we strive to maximize the positive impact of every dollar we lend. To ensure we’re making thoughtful, targeted investments, we’ve developed an Impact Rating Tool that evaluates each project across six carefully designed dimensions.

As a mission-driven CDFI, we strive to maximize the positive impact of every dollar we lend. To ensure we’re making thoughtful, targeted investments, we’ve developed an Impact Rating Tool that evaluates each project across six carefully designed dimensions.

This marks the next chapter in our journey of impact measurement. Locus first developed an Impact Rating Tool more than 10 years ago, paving the way for a more structured approach to evaluating the potential impact of a loan. This latest iteration represents a comprehensive update, aligning more closely with industry standards, including the Impact Management Project’s five dimensions of impact, while tailoring the framework to reflect our unique priorities and values.

As we launch this new tool, we are hopeful it will help us answer these fundamental questions:

- What loans make the most impact, and how do we know?

- How can we direct resources to more High Impact loans?

- How can our learnings inform new products, policies, or services?

The Six Dimensions

Our impact rating is guided by six key dimensions, inspired by the Five Dimensions of Impact plus a sixth Locus-specific dimension around strategic alignment. This ensures our investments create lasting, meaningful impact for the communities we serve.

Our impact rating is guided by six key dimensions, inspired by the Five Dimensions of Impact plus a sixth Locus-specific dimension around strategic alignment. This ensures our investments create lasting, meaningful impact for the communities we serve.

1. Community Focused – What is the intended benefit to the community?

This dimension assesses how well a project addresses the needs and priorities of the community it serves. We ask questions about the tangible benefits provided, such as the creation of affordable housing, small business growth, or access to essential community services. Our goal is to advance community identified priorities and this dimension helps us stay true to that.

2. People & Place – Who benefits from our investment?

Here, we evaluate the beneficiaries of the project and their specific needs. Does the project serve low-wealth, underserved, or disadvantaged populations? Does it benefit a historically underfunded area? This dimension ensures that our investments uplift those who need it most.

3. How Much – What is the scale, depth, and duration of the impact?

We measure the scale, depth, and duration of the impact, considering the number of people served, the significance of the benefits provided, and the expected duration of impact. For example, in affordable housing, we examine the total units created, the depth of affordability offered, and the extent to which that affordability is “locked” in for a significant duration. For small business loans, we assess the number and quality of jobs created and the likelihood that those jobs will endure.

4. Investor Contribution – How does Locus’ investment enable or enhance the project’s impact?

This dimension highlights our role as a catalytic lender. We look at how our funding fills gaps in the market, whether by offering flexible terms, taking on higher risk, or enabling a project that would not otherwise proceed.

5. Impact Risk – What is the likelihood that the intended impact will not be achieved as expected?

Not all projects are created equal, and we carefully consider the risks that could reduce or undermine the intended impact. We assess factors such as the borrower’s track record, the alignment between project goals and community needs, and the potential for unintended outcomes.

6. Strategic Alignment – How well does the investment align with Locus’ strategic priorities and focus areas?

This final dimension ensures that the project aligns with our organizational mission and priorities. For instance, we prioritize projects that meet CDFI Target Market criteria, CRA Community Development criteria, and qualified areas under the Emergency Capital Investment Program. We also prioritize projects that will be originated under special loan programs or funding sources and those that align with our Place Based Investment Strategy.

Why It Matters

Our Impact Rating Tool helps us allocate resources where they can do the most good. By evaluating each project through these six dimensions, we ensure that our lending delivers measurable outcomes and aligns with our mission to create lasting change.

Our Impact Rating Tool helps us allocate resources where they can do the most good. By evaluating each project through these six dimensions, we ensure that our lending delivers measurable outcomes and aligns with our mission to create lasting change.

This enhanced tool underscores our commitment to being at the forefront of impact-driven lending, building on over a decade of experience to ensure that every project we finance contributes meaningfully to the communities we serve.

Place-Based Investment in

Southern Virginia: What’s Next?

What does a place-based investment strategy (PBIS) mean for Locus? We believe we must understand the unique challenges of communities we work with to find solutions that advance their unique opportunities.

Last year, we shared our decision to pilot our PBIS approach in Virginia given Locus’ deep roots and history in the Commonwealth. Southern Virginia counties – and the cities of Martinsville and Danville – have historically lacked sufficient access to critical financing and technical assistance. Since then, we’ve conducted market research and countless conversations with key community and economic development stakeholders to identify regional priorities in areas aligned with Locus lending experience – affordable housing, historic preservation and development, mixed use commercial development, food system, and small business.

Read more about this project

Stay Engaged

CDFIs Create

Community Impact

The work of community development financial institutions is courageous – and more important than ever. Our mission is to help you further your mission.

Let’s create impact together.

Get in TouchIn Memoriam

Remembering Sandy Ratliff

Sandy Ratliff embodied the word “courage.” Both on the clock and off, she approached life with a contagious spirit of boldness, positivity, and determination. Including her time as Locus’ Vice President of Community Solutions, Sandy spent 35 years supporting and advocating for Southwest Virginia’s entrepreneurs and small businesses. Every single economic development partner in the Southwest counties knew Sandy. Whether it was the Noon Knowledge learning series, the Washington County Business Plan Challenge, or one of the many boards she served on, you could not have a conversation about the region’s small business community without mentioning her name.

Being courageous means pressing on even when the odds may be stacked against you. Sandy helped business owners from all over Southwest Virginia adopt this mentality, and so many of them succeeded because she was in their corner. Sandy also took this approach in her hard-fought battle against cancer. She never allowed the disease to slow her down; she did not miss a commitment or deadline, even if it meant participating virtually while receiving treatment. Those of us who were lucky enough to spend hours in her presence every week can assure that Sandy’s light never dimmed.

We miss Sandy deeply, as do her many partners and friends in Southwest Virginia and beyond. But we are comforted by her far-reaching legacy and all those who take one step closer to reaching their entrepreneurial goals because of her contributions. In a time when this community development work is more important than ever, we remember the lessons Sandy taught us about courage.